Media Cost Inflation: What to Expect in 2022

Pay more. Get less.

Consumers and marketers alike should expect to pay more for less in 2022. Why? The list goes on and on. For example, supply chain issues, labor shortages, and inflation will hit consumer spending and product availability. On top of that, data loss and increased competition are driving up media costs and impacting efficiency. For marketers, this is a one-two punch: pay more per customer acquisition and get less loyalty in return. So, how do brands succeed? By taking an aggressive approach to customer acquisition and reframing overall expectations to align with the changing economy and media landscape.

The driving force

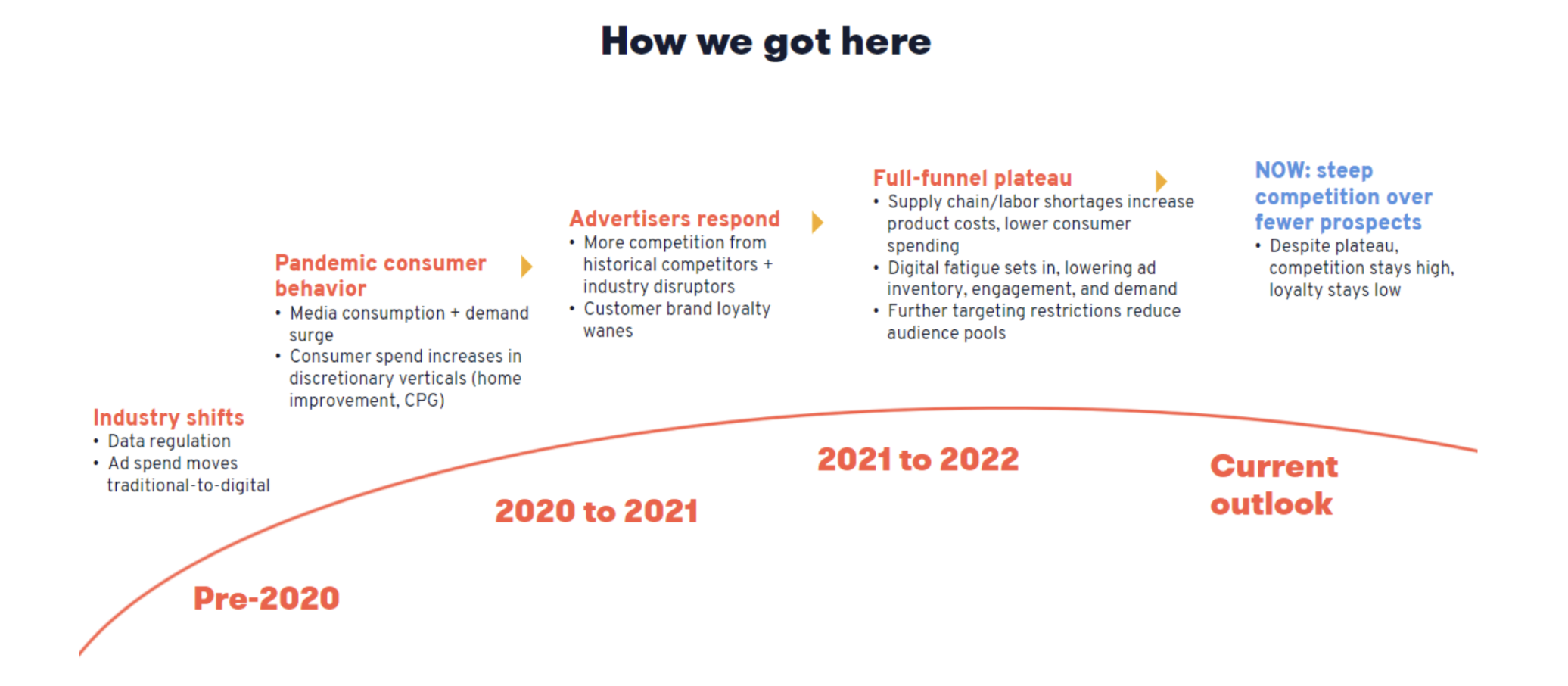

The onset of the pandemic created a surge in digital media consumption and consumer spending in new categories like home improvement or convenience-based versions of retail and healthcare. During this time, consumers and business decision makers spent more time researching online, increasing demand and opening the door to not only more advertiser activity, but also new types of competitors. Almost every industry seemed to face a new disruptor that resulted in a decline in loyalty for many brands.

Now two years later, marketers face something new: an attention recession. Screen fatigue, wanting to venture outside, the exhaustion of hearing about the pandemic and trying to find the most trustworthy news source. Consumers are tired, and digital consumption (i.e., ad inventory), engagement, and demand are waning. Other macro external factors aren’t helping either. Targeting restrictions (like Apple’s app transparency) are shrinking audience pools, while consumer spending is impacted by economic inflation and production costs, shrinking demand even further. The only thing that has not declined is advertiser spend. The result? High competition over fewer, less engaged, less willing to purchase, and less loyal consumers.

Our key findings and expectations

So, what does all of this mean? Media costs — primarily impression and click costs — likely will (or have already) show major increases in the last few quarters. While this is mostly evident in digital environments and consumer verticals, traditional media and B2B advertisers are not immune. In fact, many highly considered purchase verticals — such as healthcare, finance, tech, or niche B2B industries — have already experienced this inflation, especially moving from Q3 to Q4 2021.

But not all brands are feeling this equally. Consumer packaged goods (CPG) and retail are just starting to show signs of inflation. Additionally, automotive and manufacturing verticals are most impacted by supply chain and labor shortages rather than inflation. This means that even if demand and engagement are high, lead-to-close ratios could decline. Home improvement demand is especially unique. Many brands in the home improvement space not only suffer from the same supply chain issues, but because they are in discretionary spend categories, consumers are shifting to travel and experience-based spending rather than in-home spending.

Not yet seeing inflation? One answer is that your brand may simply be in a lucky vertical. Another is that active campaigns may be optimizing to cost efficiency, shifting budget to low-funnel tactics to drive immediate and efficient results. This strategy could pay off in the short term and look good on paper. However, remember that 2023 will be another year of upheavals (think cookie depreciation, privacy + data regulation, continuing public health crises and economic uncertainty, etc.). Scaling strategies now for long-term business growth will be important as the future likely includes less demand and engagement as the highest-intent prospects start to dwindle.

When and where is inflation occurring?

Traditional media

The World Federation of Advertisers is expecting a ~2% increase to overall traditional media costs year over year in 2022, but most significantly, a 15% TV cost increase (+18% on linear alone), with the 2022 midterm elections likely to drive prices even higher on both linear and connected TV. While print, radio, and out-of-home (OOH) will see only slight increases, traditional media publishers have been watching advertisers shift spend to digital media long before the pandemic, making this inflation more gradual than for digital. However, traditional media sellers lost an estimated $15.6B because of the pandemic (compared to only $1.7B lost by digital media sellers). Increased digital media consumption, postponement of major viewing events such as the Olympics, and advances in “hybrid” formats (think digital out-of-home or connected TV) have accelerated this traditional-to-digital spend shift and severely hurt revenue on the sell side, which must be offset by higher pricing to advertisers.

Digital prospecting + engagement

Whether marketers’ goals are traffic or visibility, both will come at a higher cost in 2022. Consumers (and their business decision maker counterparts) may be spending more time online than 2019, but not at the same accelerated levels as at the onset of the pandemic, which decreases total digital ad inventory. Additionally, platforms like Facebook that have been impacted by Apple’s cross-app tracking restrictions (with Android soon to follow) are less able to identify audiences within given parameters, making advertisers fight over even smaller targeting pools. To this end, Emarketer reported a notable 66% CPM increase year over year on Facebook and IAB predicts that advertisers will have to increase digital spend by 30%–200% to maintain similar yearly levels of ROI or media cost efficiency.

Reduced inventory — compounded by competition surges and less engaged audiences (as seen through click-through rates decreasing by 15% from Q4 to Q1 according to Skai) — means clicks will come at a higher cost. For some brands, that has already happened as Collective Measures has seen quarterly social cost-per-click (CPC) increases in both Q4 2021 (especially in healthcare, finance, B2B, CPG) and in Q1 2022 (especially in home improvement).

Performance digital

Just as top-funnel inventory and engagement are lower, so is bottom-funnel demand. Retargeting and convertor-lookalike pools shrink with less scalable traffic and data, and search volume is beginning to plateau, especially when it comes to expendable income categories like home improvement or retail. As with top-funnel media, brands are spending more in search, causing a fight over those “undecided” nonbrand searchers. And because of waning loyalty, what once were branded searches are becoming nonbranded searches, making the channel even more competitive. Skai‘s benchmark reports clearly support this trend with nearly half its accounts increasing search spend YoY in Q1 yet showing 20% higher CPC and 10% lower CTRs. In Q4 of last year, CPC increased on both keyword and shopping campaigns. Across Collective Measures’ own client dataset, paid search CPC increased from Q3 to Q4 on B2B and from Q1 to early in Q2 across home improvement and manufacturing verticals. All of these verticals also showed lower engagement at the same time.

So, what we can do?

Navigating media inflation can be complicated because each channel may be impacted differently. Here are our recommendations to keep in mind as you consider what this means for your marketing efforts:

- Set expectations and budget accordingly: Unfortunately, given all the challenges and factors outlined above, even flat annual business goals will require additional spend to see success. Work with leadership to aim for long-term business growth rather than short-term efficiency gains. Un-silo your approach, and don’t get lost in fluctuating KPIs and metrics without the context.

- Enhance informational, nonbranded content: Be the industry thought leader and answer your audience’s most pressing questions. Get those top organic search results and become a trusted expert among search engines and prospective customers. When prospects see your brand as authoritative, they are more likely to purchase from you when the time comes.

- Target broadly and contextually: Media platforms are more sophisticated than ever before, and frankly, will not perform well if micromanaged. On top of that, the evolving data privacy landscape is quickly diminishing the ability to execute campaigns against the granular targeting with which most advertisers have become familiar. Instead, cast a wider net to let algorithms find your highest intent prospects and minimize waste. Then, go back to basics with increased market visibility, contextual alignment, and non-screen formats like audio.

- Test and learn: What has worked in the past may not work now. Gather new data to understand what drives performance, whether it’s a simple A/B test or something more sophisticated such as media mix modeling or multi-touch attribution analysis to continue to make progress against business goals.

- Know your audience: Build out first-party datasets to leverage when cookie use is restricted. Understand your audience’s ever-evolving behaviors when it comes to purchasing and media consumption, and mirror their customer journey through media, content, and measurement.

One last thing you can do — BREATHE: All advertisers are in the same boat; our industry is at a crossroads. And in reality, most advertisers are not as prepared as they should be. Many are increasing investment in third-party data, sacrificing effectiveness for efficiency. Considering action items outlined above will help future-proof marketing efforts, set your brand apart from competitors, and position your business for success in the long run.